The Thome Conundrum

The discussion of the offseason for the Baltimore Orioles has focused around Chris Davis. After laying claim to another impressive season with 47 home runs in 2015, leading MLB, Davis is aimed to make upwards of 6 years/$144 million based on reports from MLB Trade Rumors. With an estimated annual salary being near $24 million, can the Orioles afford the first baseman? The Orioles aren’t the first team to struggle with such a decision for a power hitting first baseman entering free agency.

In the book Big Data Baseball, Travis Sawchick describes how current Pittsburgh Pirates General Manager Neal Huntington used historical information regarding payroll allocation to make a controversial move. Writes Sawchick:

Using the software [DiamondView], the Indians made key decisions, such as when they elected not to sign aging star Jim Thome to an extension after the 2002 season, in part because of the database, the Cleveland Plain Dealer reported. […] Huntington noted that the Indians found in a payroll analysis that no major league club, dating back to 1985, had won a World Series when committing 15 percent or more of its payroll to one player.

Jim Thome went on to sign with the Philadelphia Phillies for 6 years and $85 million. He was later traded to the White Sox after waiving a no-trade clause in his contract. Thome managed to maintain a consistent offensive production through the deal until the age of 37. He managed to put together a 138 wRC+ and hit 207 HRs during the deal. He managed an 18.2 WAR, 49th best in MLB during this time. Looking at the value as per WAR, Thome was worth around $87.9 million for the six year deal. It all seemed to work out well for the numbers, but Thome was never able to get that World Series championship for his teams.

Returning to 2002, the Cleveland Indians certainly didn’t improve from 2002 to 2003. The team went from a 74-88 team with Thome as their top player (7.4 bWAR) to 68-94 with Milton Bradley (4.1 bWAR) as their top player. Attendance crashed as well going from 2.6 million to 1.7 million. The team would eventually improve several years down the road eventually making the ALCS and losing in seven during 2007 season. However, the lost of a cultural hero for the Indians in Thome was felt by the club for years to come.

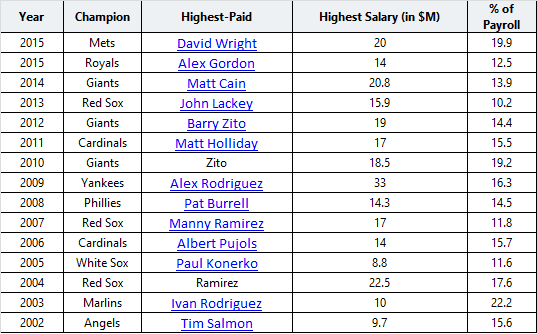

It’s conundrum that teams have to make with superstars like Chris Davis. How much money do you invest in a single player? The trend has certainly continued over the past decade with the following World Series winners and contenders in 2015:

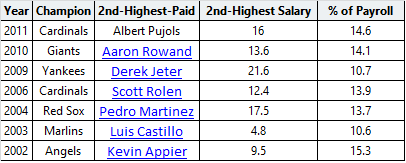

It appears as if the Thome Conundrum has slightly modified over the past decade, but overall teams have held to the standard fairly well with the average being 15.4% +/- 3.2 of payroll. With that knowledge, let’s make the assumption that the Orioles can spend up to 18.6% of their payroll (…or one standard deviation removed from the Thome Conundrum). With an expected salary of $24 million, the Orioles would need to raise payroll from the their 2015 payroll of $120 million to $130 million in order to accomplish this task. This is not an outlandish expectation for the team. However if we return to the original Thome Conundrum of 15%, the payroll would need to be raised to $160 million in order to win the World Series. Even with MASN money, payroll for a small market team like the Baltimore Orioles cannot raise by over 30%.

The Baltimore Orioles are in a tough position to decide on Chris Davis. The contractual allocation of that percentage of payroll likely limits their ability now and in the future with other mega-contracts pending (i.e. Manny Machado). Davis, like Thome, will likely be an excellent offensive player with value to match during his contract. But is that offensive production enough to balance out and fill the holes for the rest of the team. The teams that have violated the Thome conundrum have also benefited from excellent rookie classes. The 2002 The Marlins had a 23-and-under nucleus of Josh Beckett, Dontrelle Willis, and Miguel Cabrera. The 2010/2012 Giants 23-and-unders included Madison Bumgarner, Pablo Sandoval, and Buster Posey.

In addition, the teams that have violated the previous rule of 15% haven’t done so with two players. With Manny Machado likely to receive a mega-contract in the near future, the prospect of having two players making $25 million+ and taking up over 15% of the payroll is likely. The Orioles need to be aware of this roster restriction that will be coming in the back-end years of a Davis contract.

However, the team also has to be aware of the public relations and attendance impact that not signing Davis could bring as evident by the Indians drop in 2002 to 2003. The team has seen a resurgence in attendance going from 1.75 million in 2011 to 2.4 million in 2014. Winning baseball plays a large role and with an average ticket being around $25, the lost revenue for the team could be around $16 million per year for the team.

What should the Orioles do? Do you really want to know the terrifying truth?

https://www.youtube.com/watch?v=hxszN_1k6fQ